Category: Bookkeeping

Companies often use the most common splits, which are two-for-one or three-for-one, where shareholders receive two or three shares for every share held. As you can see, the investment value remains the same, but the number of shares and share price change according to the split ratio. A stock split can be declared at any time, including outside of earnings season. This can be a positive signal to investors, as it may indicate the company’s confidence in its financial performance. Stock splits themselves are neutral events that don’t change the company’s value.

Calculating the Stock Splits in a Company’s History

The two shares combined are worth the same as the one you started with, and the value of your investment remains unaffected. For instance, let’s imagine Company A has 10 million shares outstanding, and the stock is trading at $50 per share. Now, the company’s board of directors has stock splits are issued primarily to decided to split the stock 2-for-1. Immediately after the split is implemented, the number of shares outstanding would double to 20 million.

Are stock splits a sign of company growth or a red flag?

When a company is concerned that its share price is pricey and wants to make the shares affordable, the corporate action it opts for is a Stock Split/Subdivision of shares. A stock split helps companies to appeal to new investors without any addition to the market cap. A stock split is when a company issues more shares of stock to its existing shareholders without diluting the value of their holdings. Assuming no other movement in the stock price, you have $10,000 in stock both before and after the split.

What is a reverse stock split?

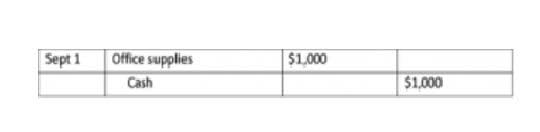

It may seem odd that rules require different treatments for stock splits, small stock dividends, and large stock dividends. There are conceptual underpinnings Balancing off Accounts for these differences, but it is primarily related to bookkeeping. The total par value needs to correspond to the number of shares outstanding. Each transaction rearranges existing equity, but does not change the amount of total equity.

For example, if Company X reaches a point where its 100 shares trade at $50, it can opt for a 1-for-2 reverse split. The process can reduce the amount of shares to 50, and shareholders would receive one share for every two shares they own, increasing the prices to $100 per share. Stock splits and stock dividends are often confused, but they serve distinct purposes. Understanding their differences helps investors interpret these actions and their implications accurately. A 10-to-1 stock split increases the number of shares by tenfold, reducing the value of each share to one-tenth of its original value.

- A company that lacks sufficient cash for a cash dividend may declare a stock dividend to satisfy its shareholders.

- Stock splits and stock dividends are often confused, but they serve distinct purposes.

- This is especially true with reverse splits that result in a post-split share price that is many times the price of the stock’s current price.

- After a 2-for-1 split, the company will have 2 million shares priced at £50 each, maintaining the same total valuation.

- For example, a 2-for-1 stock split would double the number of shares outstanding and halve the par value per share.

- Firstly, to avoid being delisted from a stock exchange for not meeting the minimum bid price required for a listing.

In a stock split, the underlying fundamentals of the company remain unaffected. The primary benefits of a stock split are often psychological and related to improving market liquidity and accessibility. Dividends are a way for companies to share their profits with shareholders. They’re usually paid quarterly or annually, and the amount is often a fixed percentage of the company’s earnings.

Share Options vs Shares: Key Differences in Equity Ownership

- As an example, if a company’s stock price is £200 and the company undergoes a 4-for-1 stock split, the price per share will become £50.

- A lower share price attracts retail investors, boosting trading volumes and enhancing marketability.

- A stock split’s most significant impact is on new investors, eyeing up a particular stock and hoping to purchase a round lot of shares at a lower cost.

- Struggling companies may do this to increase their stock price, as it can make the shares seem more valuable.

- The stocks split when the current stock price makes the units inaccessible and unaffordable for investors.

- It adjusts the share price proportionally, making it more accessible to a broader range of investors.

A company may split shares to increase the https://warranty.com.vn/what-is-working-capital-formula-ratio-and-examples/ stock’s liquidity, which increases with its number of outstanding shares. Another reason is more psychological; a high share price can act as a deterrent, making it more appealing to split the stock. Additionally, a stock split can attract new investors who found the pre-split price too high, increasing demand and the stock price. A broader investor base can also lead to increased trading volumes and a more liquid market. In terms of recordkeeping, a stock split typically doesn’t require additional recordkeeping, unlike a stock dividend.

Unit 14: Stockholders’ Equity, Earnings and Dividends

Stock splits can also generate positive market sentiment, signalling growth and confidence. Announcements often lead to short-term price increases as investors anticipate heightened demand. However, it is essential to differentiate between genuine market optimism and speculative behaviour. Understanding the broader market dynamics and the company’s position helps in making rational investment decisions. A frequent reason for a stock split is toto make shares more affordable for investors. This can increase liquidity, broaden the shareholder base, and make the stock more attractive to small investors.

Users can review and manage their personalization settings at any time, allowing them to adjust the level of personalization or opt out entirely if desired. Furthermore, the data they share is not used to inform performance for other users. Professional trust accounting support removes the need to hire and train in house staff. Law firms avoid salaries, benefits, and long term employment costs. Services are scaled based on actual workload, keeping expenses controlled. No matter your practice type, our team manages trust transactions accurately, reconciles accounts regularly, and keeps client funds protected and compliant at all times.

Timely reporting for compliance and transparency

Prepare to transform your practice, your network, and your perspective. Littler Mendelson is part of the international legal practice, Littler Global, which operates worldwide through a number of separate legal entities. Leveraging deep industry knowledge and investing time to understand your business.

Why should you trust the answers from Lexis+ AI?

Outsourcing trust accounting reduces the need for additional in-house staff, training, and office resources while ensuring expert oversight. Firms avoid full-time salaries and benefits, keeping costs predictable. Funds are managed efficiently, allowing law firms to focus The Primary Aspects of Bookkeeping for Law Firms resources on client service rather than internal accounting. This is also a good time to decide whether it’s best to consolidate tools with an end-to-end solution. Organizing time-tracking data from multiple lawyers with inconsistent tracking methods can quickly become unmanageable. Some law firm accounting platforms offer legal time tracking features to centralize data and help streamline the process.

Partnering with AZL Accountants for LAA Financial Assurance

Simplify complex legal workflows from everyday writing and contract review to legal drafting and litigation preparation. The Statutory Charge is the mechanism by which the LAA recovers its costs from a client who retains or recovers money or property because of publicly funded litigation. The firm must have clear protocols for recording payments from the LAA to prevent immediate breaches of the SRA rules. Each unit of time must be linked to a specific activity, date, and case reference that is defensible under an LAA assessment.

- These services include managing client trust accounts, client retainers, and ensuring regulatory compliance.

- These systems support trust accounting, daily bookkeeping, and financial reporting with accuracy.

- It simplifies administrative tasks, billing, and bookkeeping, freeing up time for lawyers to focus on practicing law.

- The future of your law firm’s financial health depends on the tools you adopt today.

- For most trial lawyers, that strategy is self-funding case expenses from firm capital.

- Whether cloud or on-premise accounting software is better depends on your firm’s needs, projected growth, and current resources.

TimeSolv improves accuracy, reduces admin work, and accelerates payments. You’ll avoid disputes, stay compliant, and gain real-time visibility into performance. Track time on your terms and turn it into beautiful invoices in seconds.

- However, accounting is an essential function that helps ensure your firm is profitable, your team is fairly compensated, and your accounts are compliant.

- Profit sharing calculations, capital account management, and transparent distribution of firm earnings.

- We optimize law firm financial management by providing an integrated solution that transforms legal billing from start to finish.

- No matter your model, trust accounting compliance and matter-level reporting are non-negotiable.

- Automate order tracking, inventory, and customer service for success.

- Outsourced accountants ensure that all records are accurate and comply with local regulations.

Document Management Software

- Software selection, integration setup, and team training for seamless operations.

- Expense tracking, disbursements, and profitability analysis by matter/practice area for informed business decisions.

- TimeSolv keeps every team member aligned and every deliverable on track; no micromanaging required.

- As the legal industry continues to evolve, the role of specialized accounting software will only become more crucial in helping law firms navigate their financial landscapes effectively.

- You can try TimeSolv free for 10 days to see the results for yourself.

- When combined with the best real estate brokerage software, it provides clear financial visibility and better daily property management.

- This makes it hard to track revenue accurately across all offices.

This challenge can indicate a strong need for automated trust account reconciliation. MyCase features automated expense management tools, robust legal accounting, and three-way reconciliation features. PracticePanther uses a manual expense management system, leading to a more time-intensive reconciliation process. Trust accounting for law firms manages client funds in compliance with legal and ethical requirements. We review your current trust accounts, transactions, and reconciliation practices carefully. Gaps or compliance https://thebossmagazine.com/post/how-bookkeeping-for-law-firms-strengthens-their-finances/ risks are identified early, building a strong foundation for accurate management.

Multiple Accounting Systems

We help firms avoid artificially inflating profit by correctly handling interim payments and potential abatements. Yes, outsourced accounting improves cash flow by speeding up billing, tracking payments, and managing expenses. This makes outsourced law firm accounting a cost-effective solution for multi-office firms. We record client retainers, operating expenses, billable revenue, and reimbursements. Transactions are entered following legal accounting standards as part of our white label bookkeeping services.